Why Pakistan Struggles to Save: Low Savings Threaten Economic Growth Why Pakistan Struggles to Save: Low Savings Threaten Economic Growth

Why Pakistan Struggles to Save: Low Savings Threaten Economic Growth

Pakistan has a savings problem. and it’s holding the country back.

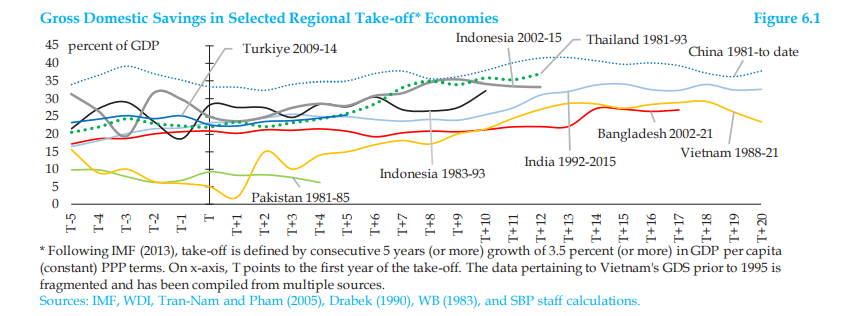

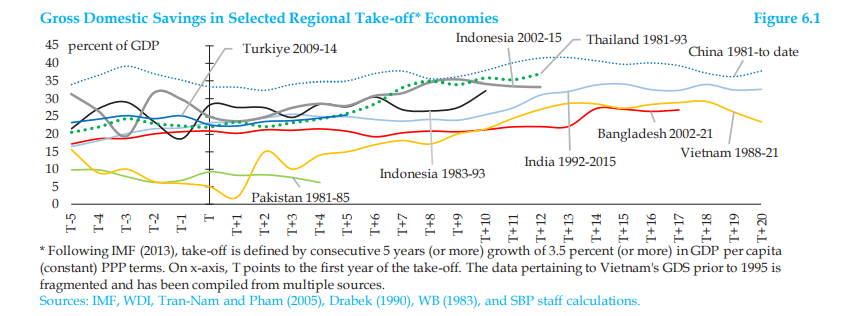

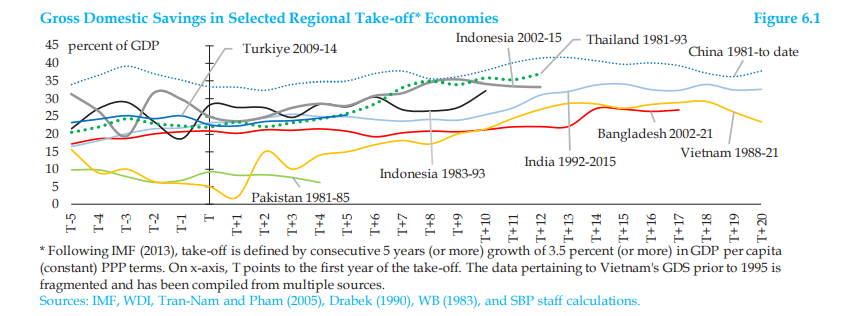

According to the State Bank of Pakistan’s latest annual report, Pakistan’s domestic savings rate is among the lowest in the world, and it’s been falling for decades.

This means that as a nation, we’re not putting aside enough money for the future, making it harder to invest in things like roads, schools, and new businesses.

Why Does This Matter?

When people and governments save money, that money can be used to build new factories, improve infrastructure, and create jobs. Countries that save more are less dependent on foreign loans and are better able to handle economic shocks.

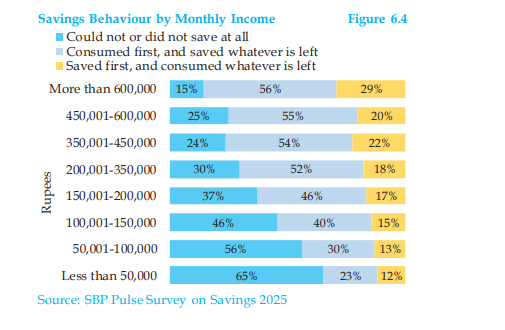

But in Pakistan, most people spend what they earn, sometimes because they have no choice.

What’s Behind the Low Savings?

The report points to several reasons. First, many Pakistanis simply don’t earn enough to save. High inflation eats away at whatever little is left after paying for food, bills, and other essentials. In fact, the average Pakistani household spends about 36% of its income just on food.

Second, Pakistan has a very young population, with many children and young people depending on working adults. This means more mouths to feed and less money left over to save.

Third, a large part of the economy is “informal”, meaning people work in jobs or run businesses that aren’t officially registered. These workers often don’t have access to banks or formal savings products, so they keep their money at home, in gold, or in informal savings groups known as “committees.”

Cultural Habits and Trust Issues

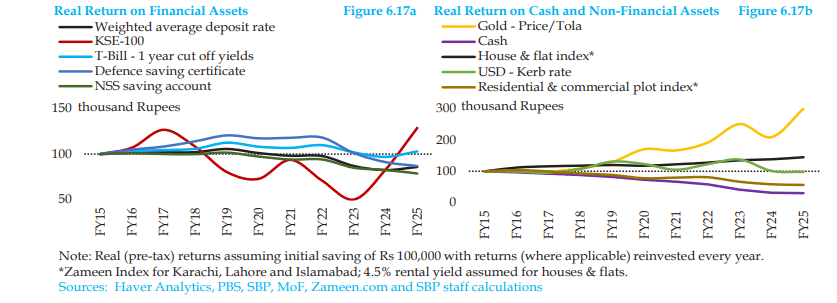

The State Bank’s survey found that even people with higher incomes often follow a “spend first, save later” approach. Many Pakistanis also don’t trust banks or find them too complicated or expensive. As a result, they prefer to save in cash, gold, or property.

The Role of the Government and Financial Sector

The government itself hasn’t been saving much either. For years, it has spent more than it earns, borrowing heavily from banks. This leaves less money for businesses and individuals to borrow and invest.

Meanwhile, banks prefer to lend to the government rather than to private businesses, which further limits economic growth.

Pakistan’s financial sector also hasn’t done enough to encourage saving. Bank deposits as a share of the economy are among the lowest in the region, and most people don’t use insurance or pension products.

The closure of the Pakistan Post Savings Bank, which once helped millions of rural and low-income Pakistanis save, has made things worse.

What Needs to Change?

Experts say Pakistan needs a cultural shift towards saving, better financial products, and more trust in banks and other institutions. The government should focus on policies that make it easier and more rewarding to save, such as higher returns on savings accounts, better access to banks, and more financial education.

There’s also a need to formalize more of the economy, so that people working in the informal sector can access safe and reliable ways to save. Reviving and modernizing postal savings, making insurance and pensions more accessible, and encouraging banks to lend more to businesses rather than just the government could all help.

The Bottom Line

Without a stronger savings culture, Pakistan will remain dependent on foreign loans and vulnerable to economic shocks. Building a habit of saving, at every level, from households to government, is key to a more stable and prosperous future.

The post Why Pakistan Struggles to Save: Low Savings Threaten Economic Growth appeared first on ProPakistani.

Powered by WPeMatico

Pakistan has a savings problem. and it’s holding the country back. According to the State Bank of Pakistan’s latest annual… Read More

The post Why Pakistan Struggles to Save: Low Savings Threaten Economic Growth appeared first on ProPakistani.