Pakistan Records One of the Sharpest Drops in Default Risk, Outpaces Most Emerging Markets Pakistan Records One of the Sharpest Drops in Default Risk, Outpaces Most Emerging Markets

Pakistan Records One of the Sharpest Drops in Default Risk, Outpaces Most Emerging Markets

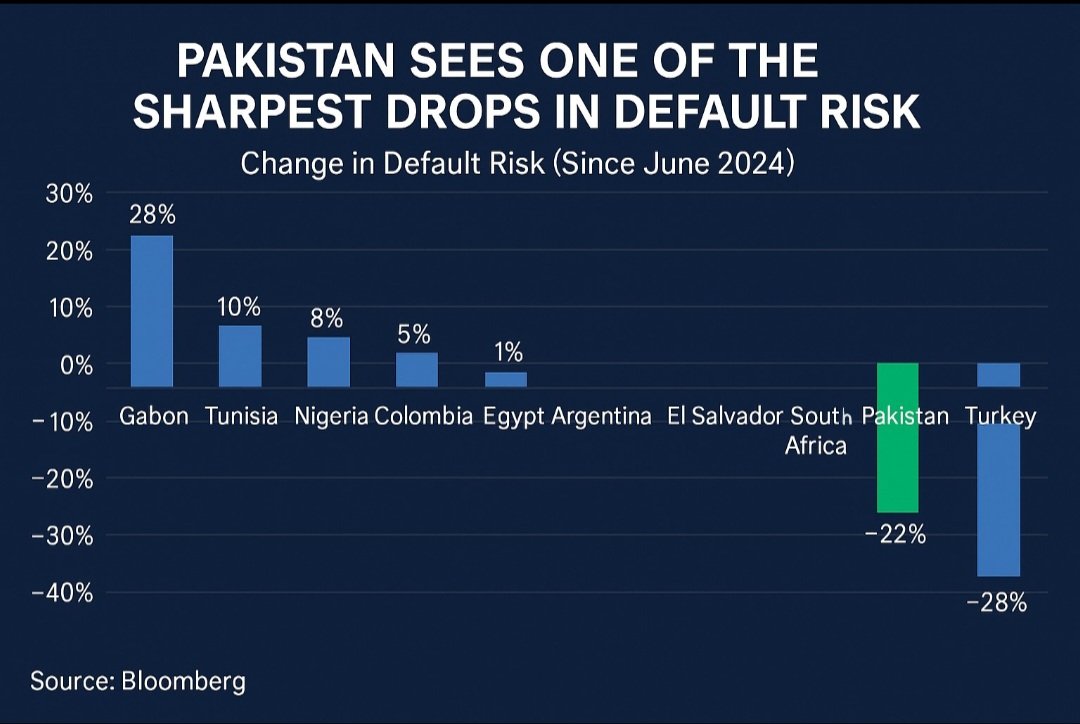

Pakistan has emerged as a standout performer among global emerging markets, recording one of the sharpest declines in sovereign default risk over the past 15 months, according to the latest data from Bloomberg.

Adviser to the finance minister, Khurram Schehzad, highlighted on Sunday that Pakistan is now the second most improved economy worldwide in terms of reduced default probability, as measured by Credit Default Swap (CDS)-implied metrics.

A Credit Default Swap (CDS)-implied probability measures how likely it is that a borrower, like a company or a country, will fail to pay back its debt.

This estimate comes from the market price of a CDS, which is a kind of financial insurance investors use to guard against the risk of default, according to the International Monetary Fund (IMF).

When the price of a CDS goes down, it signals that investors view the borrower as less risky. So, a sharp drop in Pakistan’s CDS-implied probability means global investors now see the country as much less likely to default on its debt.

From June 2024 to September 2025, Pakistan’s default probability has plummeted by a staggering 2,200 basis points. This is the largest drop among major emerging markets, placing Pakistan just behind Turkey in global rankings for default risk reduction, stated the Adviser.

Notably, Pakistan is the only country in the emerging market sample to show consistent, quarter-on-quarter improvement throughout the past year.

In comparison, other economies such as South Africa and El Salvador saw much smaller reductions in default risk, while countries like Argentina, Egypt, and Nigeria actually experienced increases.

He attributed this sharp improvement to a combination of macroeconomic stabilization, ongoing structural reforms, timely debt servicing, and Pakistan’s commitment to its IMF program. The country has also benefited from positive ratings actions by major agencies, including S&P, Fitch, and Moody’s.

“This sharp decline in risk signals strengthening investor confidence in Pakistan’s economic management and policy direction,” said Schehzad. “Pakistan is steadily rebuilding its market credibility and stands out as one of the most improved sovereign credit stories in the emerging market universe.”

The message to investors is clear: Pakistan’s consistent progress is setting it apart, making it a market to watch in the global emerging market landscape, said the Adviser.

The post Pakistan Records One of the Sharpest Drops in Default Risk, Outpaces Most Emerging Markets appeared first on ProPakistani.

Powered by WPeMatico

Pakistan has emerged as a standout performer among global emerging markets, recording one of the sharpest declines in sovereign default… Read More

The post Pakistan Records One of the Sharpest Drops in Default Risk, Outpaces Most Emerging Markets appeared first on ProPakistani.